How to Estimate and Manage Construction Equipment Costs

Once you break down construction equipment costs like ownership costs, operating costs, and hourly rates, the real challenge begins: fixing the gaps that make equipment more expensive than it should be.

In most fleets, cost overruns don’t come from bad math, they come from avoidable habits, missing data, underutilized machines, late maintenance, and decisions made without the full picture.

This section gets practical. These are the field-tested fixes contractors use to lower fuel burn, stretch machine life, improve utilization, stop runaway repairs, and keep cost-per-hour predictable.

No theory, no generic advice, just the operational moves that immediately reduce equipment waste and give you tighter control over spend.

Let’s get into the fixes that actually move the needle.

Understanding Construction Equipment Costs: Ownership vs. Operating

Before estimating costs, it’s essential to separate ownership costs from operating costs. Together, these form the Total Cost of Ownership (TCO) for each machine in your fleet.

Ownership Costs (Fixed/Long-Term)

These are expenses you pay regardless of usage, including:

- Purchase price or lease cost: Plus delivery, assembly, attachments, or tech add-ons.

- Insurance: Typically 1–2% of the machine’s value per year.

- Licensing/registration fees: Necessary to keep equipment legal.

- Storage/yard costs: Safe storage can run $500–$1,000 per month in the U.S.

High-utilization machines justify higher ownership costs because you spread the fixed costs over more hours of use.

Operating Costs (Variable)

These depend on how and where the equipment is used, including:

- Fuel: Diesel, gasoline, or electricity. Can account for the majority of operating costs. Idle machines waste thousands in fuel across a fleet.

- Maintenance: Oil changes, filters, lubrication, inspections. Skipping routine care can lead to repairs 3–4× more expensive.

- Wear parts: Tires, tracks, cutting edges, and other replaceable components.

- Downtime costs: Unplanned breakdowns reduce productivity. Large fleets may lose millions per year due to unplanned downtime.

- Jobsite/usage-related costs: Transport to site, on-site storage, and environmental impacts (extreme heat, cold, dust, or mud increase wear and fuel burn).

Operating costs are often more controllable than ownership costs through preventive maintenance, operator training, and fuel management.

Estimating Equipment Costs and Hourly Rates

Accurate estimation begins with a lifecycle cost analysis for each piece of equipment. The goal is to determine the total cost of ownership (TCO) over its useful life and translate that into a cost per year or per hour of use.

Here’s a step-by-step approach to estimating equipment costs:

1. Define the Equipment’s Life and Utilization

Estimate how long you will use the equipment (in years or total operating hours) and how many hours per year it will run. This is the useful life within your company. Also estimate what its residual value (salvage or resale price) will be at the end of that life.

2. Gather Cost Data for Ownership and Operation

Collect all relevant cost figures for the equipment: purchase price or lease terms, sales tax, delivery cost, expected financing interest rate, insurance rate, and any taxes applicable.

Do the same for operating costs: fuel consumption (gallons per hour * fuel price), scheduled maintenance costs (from manufacturer guidelines or past records), expected tire/track replacements, and typical repair costs.

3. Calculate Total Ownership and Operating Costs

Using the data gathered, compute the total ownership cost over the equipment’s life and the total operating cost over its life. A simple lifecycle formula for TCO is:

Total Cost of Ownership = Initial Purchase Cost + (Sum of all Operating & Maintenance Costs over life) – Salvage Value.

For ownership costs, include the purchase price (or total lease payments), plus financing charges (interest), plus costs like delivery and attachments, plus fixed costs over the years (insurance, taxes, storage fees, etc.), minus the salvage value expected.

For operating costs, sum up all the usage-based expenses over the life: total fuel costs (hours * consumption rate * fuel price), maintenance and repair budgets, operator wages, etc. It may help to break costs down on an annual basis first.

4. Derive an Hourly (or Daily) Cost Rate

Often it’s useful to express equipment cost in terms of cost per hour of use. This machine rate helps in budgeting and job costing, similar to how we assign hourly rates to labor.

Once you know the total life costs and expected usage hours, you can compute

Cost per Hour = (Total Ownership Costs + Total Operating Costs) ÷ Total Hours of Use

For instance, suppose a backhoe loader cost $100,000 to buy and you anticipate $40,000 in all operating costs over its life, with 2,000 hours of use before resale. If you can sell it for $20,000 at the end of life, then TCO = 100k + 40k – 20k = $120,000.

Divide by 2,000 hours = $60/hour total cost.

5. Add Contingencies and Inflation

The construction environment is unpredictable – repair costs can spike, or fuel prices can swing drastically. It’s wise to add a contingency buffer to your equipment cost estimates.

6. Use Standardized Tools and Templates

To ensure consistency, you can use cost estimation templates or software. Many companies develop a standard machine rate calculation worksheet that lists all ownership and operating cost items to be filled in. There are also specialized fleet cost management platforms that automate this process.

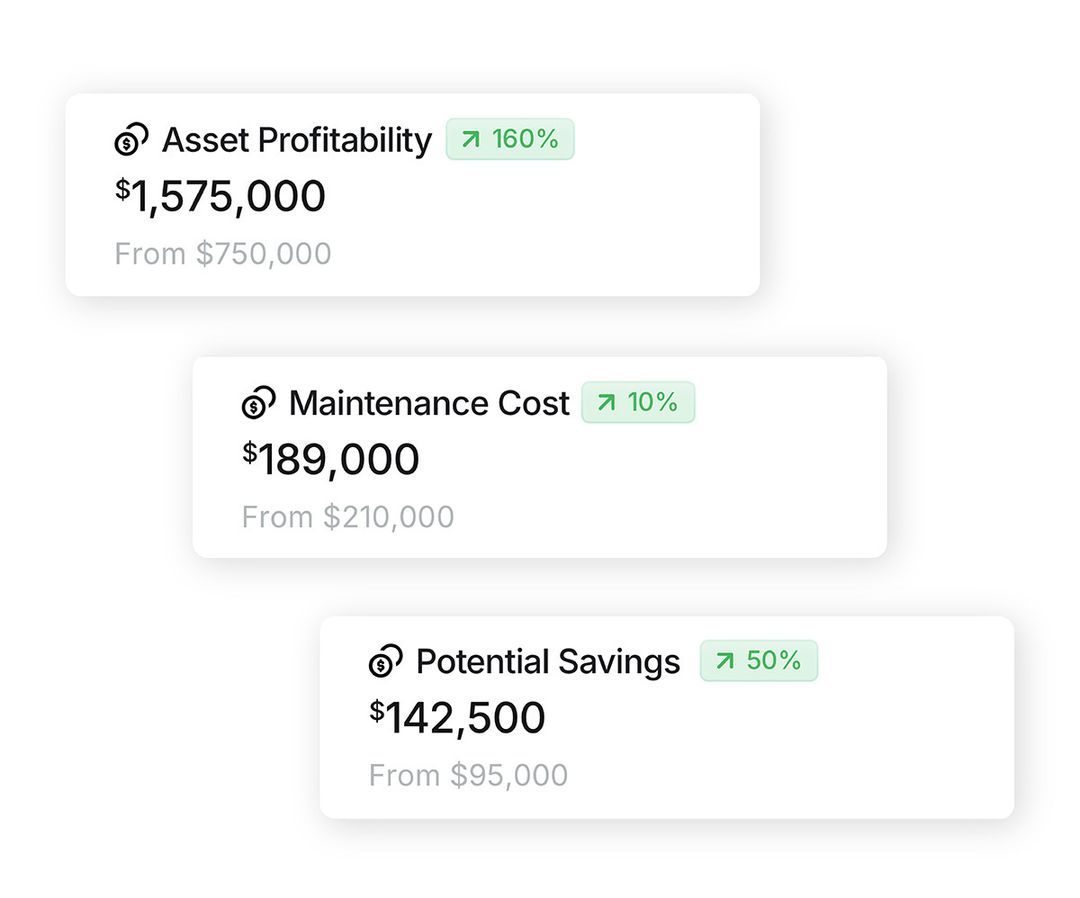

Knowing your total cost per hour goes beyond spreadsheets and guesswork. It reveals which machines are truly profitable, which projects are eating costs, and whether buying, renting, or leasing is the smarter choice.

Buy, Rent, or Lease? Evaluating Acquisition Options

An important part of cost estimation is deciding whether it makes sense to purchase equipment, lease it, or rent it for each project or task. The cost implications of these options can differ greatly:

Buying (Ownership)

If a machine will be used heavily (many hours per year) over a long period, owning it outright is often more economical. A common rule of thumb is if you need the equipment full-time, buying (new or good used equipment) tends to be cost-effective.

Ownership lets you build equity in the asset and eventually recoup some costs through resale. However, you bear all ownership costs (financing, depreciation, maintenance, insurance, etc.), so high utilization is key to “justify” those fixed costs.

So, buy core equipment that you’ll keep busy.

Renting

For short-term needs or sporadic usage, renting equipment often makes better financial sense. Rentals allow you to pay only for the actual time you need the machine (daily, weekly, monthly rates) and avoid long-term ownership costs. This is common for specialty equipment or peak workload periods.

Rental costs will include the rental company’s ownership and operating cost recovery plus profit, so the hourly rate might seem high, but you avoid upfront capital outlay and maintenance responsibilities.

Another benefit: rental companies handle transportation logistics, delivering the machine to your site, which can save you significant effort and cost (one estimate found that having the rental firm handle delivery can save a significant amount per equipment move for a contractor).

Leasing

Leasing (long-term rental or finance leases) is a middle ground. With an equipment lease, you make a monthly payment to use the machine for a set term (often 2–5 years). Leases often have lower upfront cost than purchasing, and payments might be treated as operating expenses on your books.

At lease end, you might return the equipment or have an option to buy it. Leasing can be attractive if you want to refresh equipment frequently or avoid the risk of obsolescence. The cost per hour can be comparable to buying with a loan, depending on interest rates and residual value assumptions.

Always compare the total cost over the period for buy vs. lease vs. rent. Also consider qualitative factors: ownership gives you control and availability, renting/leasing give flexibility.

New vs. Used Equipment Considerations

If you decide to buy equipment, another cost factor is whether to buy new or used. Both have pros and cons affecting cost:

- New Equipment: Buying new gives you the latest technology and a factory warranty, reducing immediate repair costs. You also get a machine with zero hours, so you can utilize its full lifespan. New units, however, depreciate the fastest in the first few years, often losing 20-40% of value in year one.

The purchase price is highest for new, but you might benefit from lower maintenance for a while and possibly better reliability and fuel efficiency. New machines typically have strong resale value if well-maintained, especially for reputable brands.

- Used Equipment: Buying used can save 25–50% off the price of new for similar models. This lower upfront cost is great for cash flow and can dramatically improve the cost per hour if the machine has a lot of life left.

However, used machines come with shorter remaining useful life and potentially higher yearly maintenance and repair costs (older equipment may need more frequent fixes).

Used equipment is a smart choice if you find a well-maintained unit that matches your needs for a shorter term, or if budget constraints are tight. Always factor in the risk of repairs: a bargain used machine can become expensive if it suffers major failures soon after purchase.

Best Practices for Managing Construction Equipment Costs

Estimating costs is only half the battle. Once you own or start using the equipment, active management is required to control costs and keep them in line with your estimates. Here are some best practices to manage construction equipment costs effectively:

1. Implement a Preventive Maintenance Program

Regular preventive maintenance is one of the most effective ways to reduce long-term equipment costs. It might seem like an expense, but it’s truly an investment that pays off. Routine tasks, daily inspections, oil and filter changes, scheduled component replacements, lubrication, etc. minimize breakdowns and costly repairs down the road.

A good rule is to budget a consistent percentage of the machine’s replacement value each year for maintenance and minor repairs, often in the low single digits for well-run fleets, rather than waiting for expensive breakdowns.

In practice, have a maintenance schedule for each asset (following manufacturer guidelines for service intervals). Track engine hours or miles to know when service is due. Many firms use Computerized Maintenance Management Systems (CMMS) or fleet management software to automate this scheduling and send reminders.

2. Monitor Fuel Usage and Improve Efficiency

Fuel is a major cost, so fuel management can yield big savings. Simple steps like reducing idle time and optimizing operating techniques make a difference.

Excessive idling burns fuel without productive work; for example, idling just 10 minutes a day can add up to more than 27 gallons of wasted fuel per year per machine across a fleet.

Use telematics or onboard idle shutoff features to curb idle hours. Train operators on fuel-efficient practices: proper gear selection, avoiding unnecessary high RPMs, and shutting the machine off when waiting. Some modern equipment has economy modes or idle management systems, utilizing them.

Even selecting the right size of equipment for the job affects fuel efficiency (an oversized machine might burn more fuel than needed).

3. Train and Support Your Operators

Your operators have a direct impact on equipment costs. Well-trained, skilled operators not only work more efficiently but also treat equipment better, leading to lower maintenance and repair costs.

Training programs should cover proper operating techniques, safety checks, and basic daily maintenance (like how to inspect and when to report issues). Additionally, encourage a sense of ownership and accountability in operators for the care of their machines.

Beyond training, operator wages themselves are a cost to manage. While you shouldn’t skimp on paying for skilled talent, ensure that highly paid operators are assigned to jobs that fully utilize their skills/equipment to get value.

4. Track Utilization and Right-Size Your Fleet

Utilization rate, the percentage of time equipment is actually working, is a key metric for cost efficiency. High ownership costs can only be justified if the machine is productive a large portion of the time.

Industry professionals often aim for utilization in the 70–80% range, but this can be challenging to achieve consistently. It’s important to measure actual usage (engine hours, miles, or days in use) for each unit. Many fleet management systems or telematics devices can log running hours and even differentiate between working vs. idle time.

Regularly review these utilization reports and analytics. If a machine has very low usage over a period, that’s a red flag, you are spending money on a mostly idle asset. At that point, consider redeploying, renting out, or selling under-used equipment.

In other cases, selling an underutilized unit and renting when needed is smarter. The goal is to “right-size” your fleet: align the number and type of owned equipment with what your projects truly require at a high utilization level.

5. Consider Resale Value and Replacement Timing

Know when to replace equipment by tracking annual maintenance costs and downtime. As machines age, repair costs rise and resale value drops. If upkeep rivals the cost of owning a newer unit, it’s likely time to sell or trade. Maintain detailed service records and keep equipment in good shape to boost resale value and reduce total ownership cost.

6. Allocate and Analyze Equipment Costs Per Project

To manage costs accurately across multiple projects, allocate equipment expenses to the jobs that use them. Assign internal rates based on ownership and operating costs, then charge projects according to actual usage hours.

Use job-coded equipment hours in your accounting system to automate this. This approach reveals true project costs, improves future estimates, and ensures equipment isn't mis-categorized as general overhead, ultimately leading to smarter bids and better resource decisions.

7. Utilize Technology and Software for Cost Management

Most contractors don’t struggle because they can’t manage costs, they struggle because all the info lives in different pockets. Hours come from the field. Fuel slips from the yard. Maintenance notes from a tech’s clipboard. Depreciation from accounting. By the time you stitch it all together, the numbers are stale, incomplete, or just plain wrong.

Modern fleet tech fixes the root problem: fragmentation.

Instead of juggling four different systems (or worse, spreadsheets), integrated platforms pull every cost-driving signal into one place, usage, repairs, fuel, inspections, depreciation, rentals, everything and update it in real time.

Some categories of useful tools include:

Equipment Management Platforms: These are built to answer the big question every PM and superintendent asks: “What is this machine actually costing me?”

A good platform centralizes spend on fuel, repairs, parts, insurance, and job charges. Add telematics, and things get sharper, engine hours, utilization, idle time, and fault codes are pulled straight from the machine. Suddenly you’re not estimating cost per hour and you’re seeing it live.

Maintenance Management Systems (CMMS): When your maintenance program scales past sticky notes, CMMS takes over. These tools schedule PMs, log work orders, track parts usage, and help you understand how much a machine is costing you to keep alive. Some systems even pick up patterns from fault data and trigger early warnings before a failure becomes a five-figure repair.

Fleet and Asset Tracking Systems: Think of these as the raw data layer: where the machine is, how it’s being used, whether it’s idling all day, whether it’s due for service.

On their own, they don’t manage costs, but when they feed into a unified platform, they directly shape decisions that prevent waste and downtime.

Construction ERPs and Accounting Systems: These handle the financial backbone: depreciation, internal rentals, job cost allocations, equipment revenue. Essential for the back office, but blind without field and machine data plugged in.

Clue an All-in-One Platform for Managing Construction Equipment Costs

This is where that earlier “disconnect” disappears.

If all these systems stay separate you’re managing data, not equipment. Nobody wants that.

Clue closes that gap by bringing every operational, mechanical, and financial signal together in real time. Telematics data, fuel usage, preventive maintenance schedules, job allocations, and cost per hour, all of it feeds a single, unified view of your fleet’s equipment economics.

Instead of chasing information across tools, Clue becomes the single pane of glass that the field and office both trust.

- It doesn’t replace your ERP, it feeds it better numbers.

- It doesn’t replace your maintenance team, it gives them stronger visibility.

- It doesn’t replace telematics, it turns the raw data into decisions.

The value isn’t the software. It’s the clarity.

You finally see what each machine is costing you today, what it’ll cost you tomorrow, and where money is leaking before the month-end meeting tells you too late.

That’s the difference between managing equipment, and controlling it. That’s exactly where Clue stands out. Clue isn’t just another software add-on, it’s a single source of truth that combines equipment telematics, cost tracking, equipment management, and real-time project-level visibility into one streamlined dashboard.

It bridges the gap between the field and the back office by pulling live data from your machines and turning it into actionable insights across your entire fleet.

Whether you’re allocating hours to projects, calculating cost per hour by asset, planning replacements, or tracking preventive maintenance, Clue centralizes the entire process. No more toggling between systems or waiting for reports.

With Clue, you know exactly what each piece of equipment is costing you, how it’s performing, and where you can cut waste or downtime, without lifting more than a finger.

Conclusion

Effectively estimating and managing construction equipment costs is vital for profitability and competitive success. It’s clear that a machine’s true cost is far more than its purchase price, you must account for ownership costs (like depreciation, financing, insurance, taxes) and operating costs (fuel, maintenance, repairs, labor) to get the full picture.

By calculating a total cost per hour or per year for each piece of equipment, you gain a powerful decision-making tool that guides budgeting and bidding.

FAQs

How do you calculate the cost per hour of heavy equipment?

Add ownership and operating costs, subtract salvage value, and divide by the expected total operating hours to determine the cost per hour.

How to estimate true cost when utilization is low?

Underutilized machines spread fixed ownership costs over fewer hours, increasing cost per hour. Tracking usage data helps optimize fleet size and usage.

How much do depreciation, insurance, taxes, and storage add to equipment cost?

Ownership costs can contribute a significant portion of lifecycle cost often 20–40% in the first few years, so it’s critical to account for them in TCO calculations.

Transform Your Equipment Management

.webp)

.webp)