What is Accumulated Depreciation? Is it An Asset?

Heavy construction equipment management does not simply involve maintaining and managing how your equipment operates. It also involves knowing their financial worth in the long-term. Any excavator, dozer or crane your company owns is an asset and just like any asset, its value diminishes with use. That decrease is calculated by depreciation, and the accumulation at any point of time of all depreciations made is referred to as accumulated depreciation.

Through this guide, we will unpack the concept of accumulated depreciation, its importance, presentation in the financial statements and how modern construction ERP software and CMMS systems can automatically track it.

To that end, we will utilize practical examples and situations pertaining to the field in order to get you to bridge the gap between the accounting concepts and fleet management in practice.

What is Accumulated Depreciation?

Accumulated depreciation is the cumulative depreciation, which has been expensed against a piece of equipment since the acquisition of the equipment. It is entered in a contra-asset account (i.e. offsetting the cost of an asset and not appearing under assets or liabilities).

Equipment value on the balance sheet is shown as:

Original Cost – Accumulated Depreciation = Net Book Value

Example in Construction Terms

- You buy an excavator for $100,000.

- You plan to depreciate it over 10 years, $10,000 each year.

- After 3 years:

- Total depreciation recorded = $30,000

- Accumulated depreciation = $30,000

- Net book value = $70,000

This excavator is still operable and perhaps even able to gain or lose in the resale revenue, but in your accounting, its book value is $70,000.

Is Accumulated Depreciation an Asset?

No, accumulated depreciation is not a regular asset. It’s a contra-asset account linked to fixed assets. Instead of adding value, it reduces the book value of equipment or property on the balance sheet, showing how much of the asset’s cost has been expensed over time.

Why It Matters

Debit balances are normal accounts of assets (like cash or equipment). Accumulated depreciation on the other hand has credit balance, and it is reported on the balance sheet immediately under the equipment account, and it lowers down the total value of the equipment.

This provides the financial stakeholders with a clear view on the purchase cost of the original equipment they bought, the total depreciation they have had to date and the net book value of the asset they have left.

Why Accumulated Depreciation Matters in Construction

One of the industries that mostly utilizes accumulated depreciation is construction. It is important to understand that not only is this an accounting exercise in understanding accumulated depreciation but also that the process has an immediate impact on operations, budgeting, and decision-making.

Key Reasons It Matters

1. Asset Value Transparency

Accumulating depreciation gives raw data on the extent to which an equipment value has already been expended as a result of utilization and terminal use. For construction teams, this is not just an accounting exercise. Superintendents are able to gauge the machines that are approaching expiration of productive life and strategize on the same.

It can guide fleet managers to know which of their assets is overworked or underutilized and require replacement or substantial upkeep. This is also important to CFOs and finance teams to depict an accurate balance sheet of the health of assets.

2. Budgeting for Replacements

Depreciation schedules act like a roadmap for capital planning. When a bulldozer or excavator is already 80 percent depreciated, it indicates a replacement would probably be needed soon, even though the work equipment may be operating.

It lets the companies predict their cash flow requirements, depreciate expenses and investments and is not caught by the replacement costs that may take their toll.

Construction firms can make key decisions based on these capital outlays because the timing of equipment replacement is aligned with the project demand and funding has been made available.

3. Fair Financial Reporting

Reporting-wise, accumulated depreciation means that the balance sheet of the company does not exaggerate the worth of its equipment set.

Depreciation should be recognized as required under the standards of GAAP or IFRS by the banks, auditors and the investors.

The trust obtained through building credibility is not the only outcome of transparent reporting because this system also allows companies to take available loans and prevents potential investor loss of confidence.

Transferring equipment at exorbitant price, however, poses constraints to compliance and may give stakeholders the wrong explanation on the actual financial status of the company.

4. Insurance and Resale Decisions

The other reason as to why accumulated depreciation is important is that it is used in insurance and resale planning. Net book value (orig. purchase price less accumulated depreciation) offers a baseline on which to determine the value of the asset on paper.

Even though the actual resale or market value would be different, the use of a clear internal benchmark facilitates decision-making. It is also effective in discussions on insurance, companies would resolve either to insure at the replacement cost or to make distinctions in accordance with the book value.

To determine the starting point that is reasonable, both the buyer and the seller can use accumulated depreciation when negotiating resale.

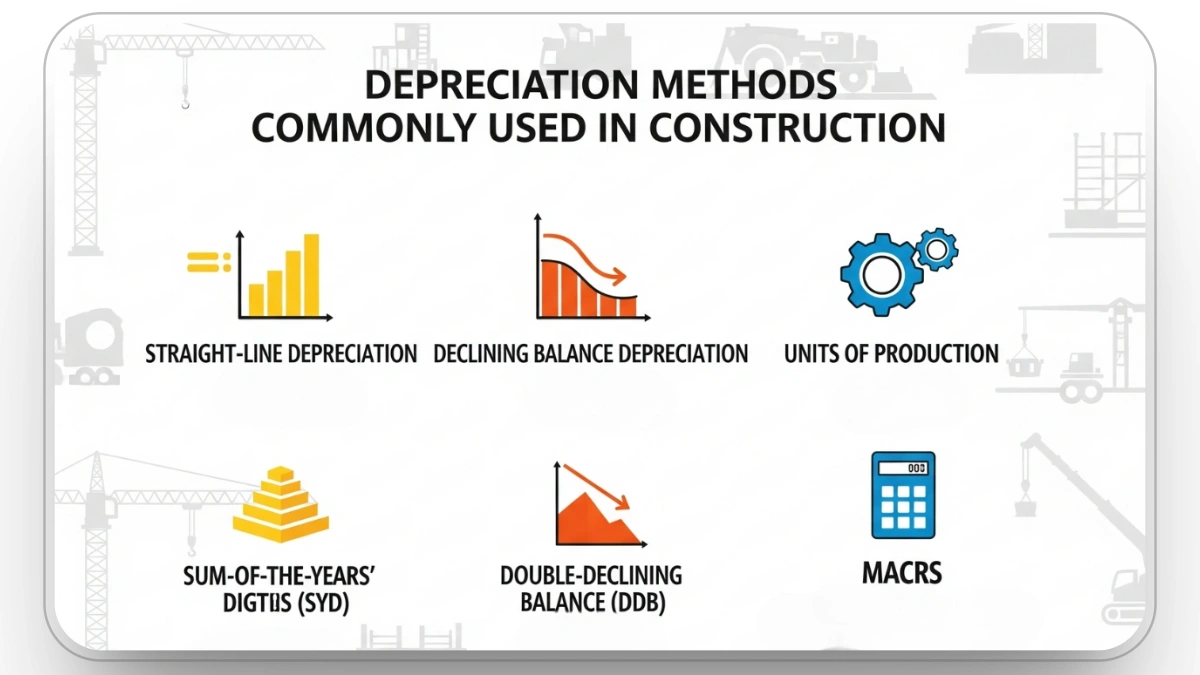

Depreciation Methods Commonly Used in Construction

The way you calculate depreciation affects how accumulated depreciation builds up. Different methods suit different equipment types and business models.

1. Straight-Line Depreciation

- Spreads cost evenly over useful life.

- Best for assets that lose value at a steady rate.

- Example: $100,000 excavator / 10 years = $10,000 each year.

2. Declining Balance (Accelerated Depreciation)

- More depreciation in the early years, less late.

- Good for equipment that loses resale value quickly.

Example: Apply 20% depreciation each year on the remaining book value.

3. Units of Production

- Ideal when fleets have to work by workload, rather than time.

- Based on Utilization: number of hours worked, number of miles driven or tonnes moved.

Example: Dozer should run 20,000 hours in all. It has a run length of 2,000 hours this year, and that is 10% of its life, or 10% of the annual cost depreciated.

4. Sum-of-the-Years’ Digits (SYD)

- Accelerated method but less aggressive than declining balance.

- Useful for certain tax strategies, though less common in construction.

5. Double-Declining Balance (DDB)

- A faster version of declining balance, using double the straight-line rate.

- Useful for heavy-use equipment that becomes obsolete quickly.

Example: Straight-line = 10%, so DDB = 20% applied to book value each year.

6. MACRS (Modified Accelerated Cost Recovery System)

- These will be required as tax information in the U.S.

- Blends declining balance with straight-line, plus conventions like the half-year rule.

How Accumulated Depreciation Appears in Financial Reporting

1. Balance Sheet Presentation

Mechanized equipment is usually recorded on the balance sheet of a construction company at costs of original purchase and amassed depreciation depicted as a credit. For example:

- Equipment (at cost): $500,000

- Less: Accumulated Depreciation: ($200,000)

- Net Book Value of Equipment: $300,000

This format enables the financial stakeholders to visualize the three things simultaneously, namely the cost of the original fleet, the cumulative amount of depreciation and the book value left.

This level of visibility is essential to equipment-intensive contractors. It ensures management, auditors, and lenders can quickly assess the true financial weight of the fleet without losing sight of historical investment.

2. Asset Registers

Behind the summarized line items on the balance sheet sits a more detailed fixed-asset register or schedule. This register includes:

- Purchase date: When the equipment was originally acquired.

- Original cost: The amount paid to bring the equipment into service.

- Useful life: The approximate time (number of years) or machine-hours of the equipment that will be productive.

- Depreciation method: Straight-line, declining balance or usage-based.

- Accumulated depreciation: The cumulative depreciation as per to date.

- Net book value: The equipment’s remaining accounting value.

These registers are not only paper work. They are the foundation of internal decision-making (when it's needed to replace/overhaul) and external financial reviewing.

The accuracy of such records will be regularly tested by the auditors in order to verify that depreciation is being determined properly and continuously applied.

3. Flow Through Financial Statements

- Income Statement: Depreciation is recognized in the income statement, and it lowers reported profit. Although the expense is not cash, it effectively reduces taxable income, and this is significant in tax planning.

- Balance Sheet: The balance sheet reflects the impact of accumulated depreciation by reducing the book value of equipment. Instead of showing inflated values for aging assets, the balance sheet provides a net figure that reflects the realistic carrying value of the fleet.

- Cash Flow Statement: The depreciation is not considered an actual cash payment, thus it is included in the operations activities in the cash flow statement. This adoption is to make sure that net cash of operation is used to indicate only cash movements that are realistic.

Regulatory and Tax Considerations

Construction companies operate under strict accounting and tax rules. Depreciation must follow standards.

GAAP vs IFRS

- GAAP (U.S.): Allows multiple methods, commonly straight-line and accelerated.

- IFRS (international): Requires systematic allocation over useful life; component depreciation is emphasized (breaking an asset into parts).

MACRS (U.S. Tax Code)

- Modified Accelerated Cost Recovery System.

- Allows faster depreciation for tax purposes than for financial reporting.

- Example: A bulldozer may be depreciated over 5 years for tax even if you expect to use it for 10 years.

Why It Matters

- Financial reporting depreciation (book depreciation) shows true equipment value.

- Tax depreciation (IRS schedules) reduces taxable income.

- Most construction ERPs allow dual depreciation tracking, book vs tax.

How Construction Software Handles Accumulated Depreciation

Tracking accumulated depreciation manually in spreadsheets is risky. Modern ERPs and CMMS tools automate it.

ERP Systems (Accounting + Equipment)

- Oracle NetSuite: Asset Register lists cost, accumulated depreciation, and book value.

- Acumatica: Provides roll-forward reports of additions, disposals, and depreciation.

- Microsoft Dynamics 365 Business Central: Shows accumulated depreciation at period end.

- Foundation Software (Construction ERP): Posts depreciation entries automatically using GAAP/tax rules.

CMMS / Equipment Management Tools

- Fexa: Stores depreciation schedules with maintenance history.

- Asset Panda: Shows current depreciated value for each machine.

- Clue: Connects usage data (hours, fuel, repairs) with financial reporting for a complete asset lifecycle view.

How Clue Supports Accumulated Depreciation & Asset Value Management

Managing accumulated depreciation isn’t just an accounting exercise, it’s about having the right data to make smart decisions about your fleet. Construction equipment doesn’t lose value on a neat, predictable curve; usage, maintenance history, idle time, and job site conditions all play a role.

That’s where Clue comes in. While Clue isn’t a replacement for your accounting system, it provides the operational insights like utilization, hours worked, maintenance costs, and condition, that directly shape how accurate your depreciation schedules are.

By tying real-world equipment data to financial reporting, Clue helps contractors align book values with reality, budget for replacements more effectively, and extend asset life through proactive maintenance.

Final Thoughts

In construction, equipment is both the backbone of operations and a major financial investment. Accumulated depreciation provides you with a discipline approach, so clear on how much of the value of a certain machine has been consumed.

By combining accounting standards with modern fleet software, contractors gain a transparent view of their assets’ true value. This visibility drives smarter capital planning, more accurate project costing, and stronger financial health across the company.

When you see an excavator on site, it’s moving earth. On paper, accumulated depreciation tells you how much of its value remains, how long before it should be replaced, and how it impacts your bottom line.

Are you ready to get more out of your fleet? That is why with Clue it is not simply that you track equipments, you know their true value.

Whether it's insights into utilization and maintenance or smarter replacement planning, Clue will provide you with the knowledge to make depreciation manageable and the balance sheet accurate.

Transform Your Equipment Management

.webp)